Post Modern Portfolio Navigation

Everybody knows where they are financially and many investors know how far they have to go to receive a future payout. But many firms use outdated investment theories to get investors where they need to be.

The result is most investors go off in the wrong direction chasing some random variable that is unrelated to their financial goal.

Post Modern Portfolio Navigation changes that, for the better.

Tactical Asset Allocation – 1950’s vs Now

Getting from where you are financially to where you need to be can be viewed as a navigation problem.

All navigation problems require the calculation of a heading to get you to your destination.

The financial equivalent is called the Essential Returns Objective® or ERO®.

It is the return one needs to earn on assets in order to achieve some future payout.

That future payout could be a lump sum or a series of cash outflows.

In either event, ERO is as simple as calculating the internal rate of return (IRR) that discounts the future outflows to the inflows.

Portfolio Theory, developed by Harry Markowitz, and the Capital Asset Pricing Model (CAPM) developed by Bill Sharpe, deal with how rational investors should make the trade-off between risk and reward when selecting a portfolio.

We will refer to these theories collectively as modern portfolio theory (MPT).

We are indebted to them for providing an initial risk-return framework for others to build on.

But that was over 68 years ago and there is a need to apply some of the advancements in financial theory known as Post Modern Portfolio Theory (PMPT) for smart investing.

We know of no textbooks on MPT that discuss goals dealing with cash inflows and cash outflows.

By assuming that every investor has the same investment objective, maximize the expected return for a given level of risk, MPT implies that all investors have the same goal, to make money.

Portfolio navigation (PN) assumes investors have different goals.

For a defined benefit plan the goal might be explained as: fund the pension plan within certain cost constraints.

A participant in a defined contribution plan might describe the investment goal as: provide an income stream to replace 70% of my salary at retirement.

An endowment fund might describe their goal in terms of funding certain projects.

A family might have a goal of funding their children’s college education.

Making money is how one accomplishes each goal, it is not the goal in and of itself.

Figure 1 below illustrates the essential difference in the way MPT investors and PN investors would choose between portfolio (f) and portfolio (g).

MPT claims that all investors would choose between portfolio (f) and (g) in Figure 1 based on their risk tolerance.

We claim that all PN investors who have a ERO equal to or greater than 8% would prefer (g) to (f) because investing in (f) would guarantee failure to achieve 8%.

How can two theories come up with such different answers? Because they make different assumptions and therefore measure risk and reward differently.

MPT investors focus on the mean or average return in Figure 1 and measure risk as deviations either side of that mean.

The investment objective for all MPT investors is to maximize the expected return for an acceptable level of risk that is determined by the MPT investor’s utility function.

Assuming both (f) and (g) lie on the efficient frontier, the MPT investor would choose portfolio (f) if his utility function was tangent at the mean of 4%.

In fact, there are some who think the government should eliminate 401(k) plans and require all participants to sign up for a government guaranteed 4% retirement plan.

The focus for the PN investor in Figure 1 is the ERO, or internal rate of return (IRR) that links the asset inflow stream to the liability payout stream in the future.

Risk is that returns fall below the ERO because those returns incur risk that the goal will not be accomplished.

Returns above the ERO are the reward one gets for taking on the downside risk.

The ERO is an estimate of the IRR needed to transport the PN investor’s portfolio from where it is now to where it needs to be at some time in the future.

The PN investor would reject portfolio (f) because it literally guarantees failure to accomplish the goal that requires an 8% ERO.

The entire distribution of portfolio (f) lies below this investor’s ERO.

The investment objective for the PN investor is to maximize the potential to exceed the ERO relative to the risk of falling below the ERO.

This goal oriented trade off is measured as the upside potential ratio shown below:

Previous authors measured upside potential as the probability of achieving a return above a given target, in which case the exponent in the numerator of equation (1) would be zero.

We believe upside potential should have a magnitude factor so that 4% more than the ERO is twice as good as 2% above the ERO.

While Asst Liability Models (ALM) and Value at Risk (VaR) models associate risk with the probability of a bad outcome, we believe risk should be squared as shown in equation (1).

We then take the square root to convert the denominator to the same units as the numerator.

Therefore, an upside potential ratio of 1.2 would indicate the portfolio has 20% more upside potential than downside risk.

To help the reader visualize this we present a graphic illustration of upside potential and downside risk in Figure 2.

Figure 2 is meant to illustrate the inadequacy of probabilities to capture the upside potential or downside risk.

The white area under the curve of (g) to the right of the ERO is the probability associated with returns above the ERO and captures the chance of a good outcome.

But this ignores the magnitude factor of how much better a 12% return is than a 10% return.

The curved line to the right of the probability density function for (g) that declines as the probability approaches zero adds the magnitude factor (hatched area).

On the other hand, returns below the ERO are squared and are therefore far greater than just the area below the ERO®, as shown in Figure 1 for portfolio (g).

Unlike semi-variance, downside risk is measured as deviations below the ERO which is not a random variable like the mean.

It is also not an arbitrary choice the investor would like to earn. The ERO is the link between cash outflows and cash inflows.

Empirical Evidence

We now show how this impacts the decision of whether or not to use active managers. Let’s assume an asset allocation given in Figure 3.

Portfolio (f) is a portfolio consisting solely of the passive indices shown in Figure 3.

Portfolio (g) is an optimal combination of active managers and passive indicies shown to the right of the portfolio distributions.

Once again, MPT would claim that portfolio (f) is less risky than portfolio (g) (std 7.7% versus 11.2%) and since they both have approximately the same Sharpe ratio (.81 versus .88) one could not say one portfolio is any better than the other so why pay for active management?

In truth, a mean variance model would force both of these distributions to be symmetric.

We use PMPT to calculate some meaningful statistics otherwise unavailable without knowing the ERO.

The downside deviations are almost the same (5.1% vs 5.6%) but the upside potential for (g) is 6.5% versus 3.1% for portfolio (f).

The risk-reward tradeoff for (g) is 1.2 (20% more upside potential than downside risk) while portfolio (f) has an upside potential ratio of only .6 (40% more downside risk than upside potential.

Furthermore, the ERO alpha indicates that the combination of active and passive managers could deliver 3.6% more return in any given year than the purely passive portfolio.

The average downside is a conditional mean. Given a return below the ERO, on average it would be -5.8% for the passive portfolio (f) and -7.2% for the active portfolio (g).

ERO® as a Self-Correcting Navigational Tool

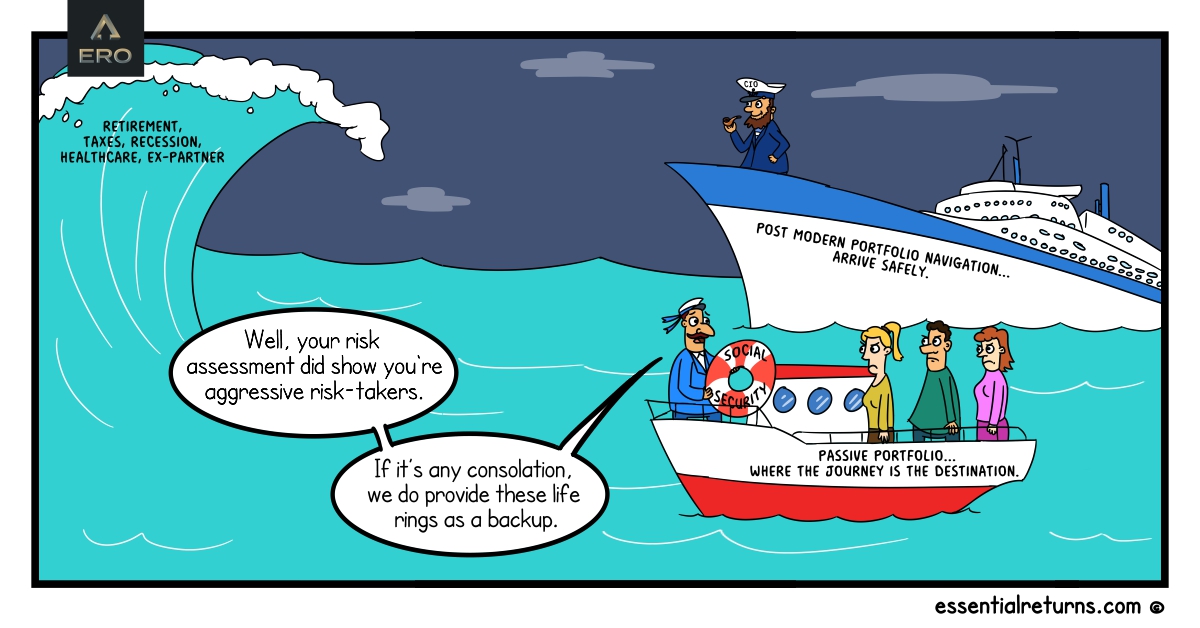

Whether a navigator is on a ship or an airplane he needs to know how to plot a new course to his destination when the winds of fate blow him off course.

The same is true for those who would help investors navigate the vagaries of the financial markets.

Forecasts are bound to be wrong sometime and that is when it’s good to know something about portfolio navigation. The following is an example of how that works.

Assume an investor has 700 units of assets. A unit could be $1000 or $1 billion.

The income is 100 units and the annual cash inflows are 3.5 units.

In eight years the investor is going to need 70 units a year for the life of the project.

These assumptions would be applicable to a capital budgeting project as well as a 401(k) plan participant, an endowment fund, a defined benefit plan or any other investment involving future cash outflows.

We will use the 401(k) case since it is assumed by many to be the most difficult to manage on an individual basis.

ERO® Portfolio Navigation Example

Let’s assume Martha is 57 years old and wants to retire at age 65.

Her current salary is $100,000 per year and she has $700,000 in her 401(k).

She only contributes $3500 each year.

All of this information is readily available on each plan participant and is sufficient to calculate a ERO of 8%.

To simplify the calculations we will assume the manager only invests in the S&P 500 SPYDR (SPY) and the iShares short term bond fund (SHY).

Of course, there are other investment alternatives, but we are focusing here on the value of the ERO calculation in steering a portfolio through the worst stock market collapse in our lifetime.

We will assume a 70/30 stock to bond mix for an 8% ERO, an 80/20 mix for a 10% ERO and a 90/10 mix for a 12% ERO (which is the highest allowed).

Portfolios are valued on the 1st of the month.

The initial investment in a managed QDIA account is made at the top of the market in 2007 when the SPYDR was at 1425 (see Figure 4 below, S&P 500 Chart 2007-2011).

In September 2008 the portfolio value declines to $613,939 and the ERO calculation is now 9.6% so she is put into the 10% ERO portfolio.

Equity has declined to 63% of the portfolio so it must be increased to $491,151 and the $3500 contribution is added to SHY.

By December 2008 the portfolio has declined to $513,675 and the ERO is now 12% so the mix is changed to 90/10.

Unfortunately the portfolio continues to decline until February 2009 at which time the portfolio is now down 39%. Warren Buffett lost more than this.

The ERO is now 17.7% but the maximum allowed is 12% (see foot note 4).

Now the market begins to recover, so by November 2009 the portfolio value is $625,264.

Note, the ERO was 10% when the portfolio value was $613,939 in September of 2008 but Martha is now two years older.

So, the ERO calculation is still 12%.

Suppose Martha is now informed that she could lower her risk to a 10% ERO by changing her retirement age to 66 or increasing her contribution.

It would make this example look much better if she increased her contribution substantially, so we will assume she only delays her retirement by one year and that she never gets a raise in salary. Her ERO now changes to 10%

By February 2011 the portfolio has reached $746,889.

Her portfolio would now be up $46,889 from her initial investment and her ERO is back to 8% for a 70/30 mix.

Even starting at the top of the market, increasing equity just before the second decline in 2008 and increasing equity again before the bottom in 2009, portfolio navigation would have gotten Martha back on track.

If Martha had simply invested 100% in the S&P index she would still be down -7.3% for a $51,100 loss.

Of course, no strategy is going to work for all investors all of the time.

But this example of portfolio navigation refutes the notion that investors need 15 years to recoup losses from a major stock market decline.

How much would the portfolio have to earn to achieve the payout of 70% of salary for the remainder of Martha’s life?

Our calculator is programmed to require a 6% return from the last 3 years before retirement through the life time projected by available mortality tables.

Frequently Asked Questions

1. Martha might live longer than the mortality tables project and it may not be possible to earn 6% compounded for the rest of her life.

True, but isn’t it better to give her the opportunity to have this uncertainty professionally managed toward her goal than to force her to live on 1/3rd less income than she needs from a government guaranteed 4% program?

Again, there can be no guarantee that portfolio navigation will always work.

Every year a plane crashes somewhere, which leads some people to refuse to fly anywhere, anytime. Investing, as opposed to saving, requires one to take some risk.

Those who are unwilling to do so must set more modest goals than people like Martha.

We deliberately chose the most frightening investment period in our lifetime and one in which most small investors bailed out of stocks and went into guaranteed savings while Martha’s portfolio went from 70% equity to 90%.

This is why we should not expect Martha to fly her own plane even in normal times let alone during a hurricane.

However, airline companies with professional pilots are deemed by the government to be a benefit to society and a reasonable risk for most of us.

Likewise, 401(k) participants need professionals to transport their portfolio over time.

2. The ERO cannot be known with certainty so why bother?

That is like saying; one can never know what compass heading to steer in order to fly from San Francisco to Hawaii.

There are lines of magnetic variation from the north pole that throw compasses off, and even if you steer a magnetic heading, the winds aloft are sure to be different than when estimated before take-off.

That’s why navigators check their position often to make the necessary corrections to get to their destination.

Portfolio management should provide that position check for investors.

Without a proper flight plan for your destination, you may find yourself on the world’s fastest plane to someone else’s destination.

3. There are already a number of ALM strategies. Why reinvent the wheel?

There are other asset-liability management strategies but we are unaware of any that bother to calculate the IRR that links assets to liabilities.

Without it one cannot calculate the risk of falling below the ERO or the potential to exceed it.

We can see no justification for refusing to periodically calculate the IRR that links cash inflows to cash outflows.

While we have trademarked the term ERO to protect a commercial service, we freely admit it is simply an internal rate of return that any first year business school student could calculate.

The ability to calculate the statistics in Figure 3 requires more advanced degrees.

4. What’s the difference between the ERO and the expected return? If your client needs to make up a loss, just slide up the efficient frontier to a higher expected return for a given level of risk.

The ERO is an IRR that must be earned on the assets in order to pay off the liabilities. The expected return on a portfolio of assets is unrelated to the liability stream.

It is highly unlikely that a portfolio selected from a mean-variance optimizer would be the same as a portfolio constructed as shown in Figure 3 that optimally combines active and passive managers to maximize the upside potential relative to the downside risk.

5. Is there a theoretical foundation for the portfolio shown in Figure 3 that is consistent with expected utility theory?

The cornerstone of our theoretical foundation is the work of Peter Fishburn but it also includes the accomplishments of Bradley Efron at Stanford, Atchison & Brown at Cambridge and many others associated with PMPT.

Fishburn’s utility function and its close relationship to the upside potential ratio is discussed in detail by our colleagues at Groningen University in a book co-authored with professor Stephen Satchel at Cambridge University (see chapter 10 of “Managing Downside Risk in Financial Markets, Amazon.com).

The MPT use of utility theory starts by using standard deviation as a measure of risk to estimate the investor’s tolerance for risk which leads to a portfolio that maximizes the mean for that level of volatility.

For liability driven investing, we believe this is the wrong measure of risk which leads to the wrong utility function and the wrong portfolio.

We think behavioral finance provides evidence that this MPT use of utility theory is counterproductive.

6. What if the client’s ERO® is 35%?

At some point the client has to be told, “You can’t get there from here.” We recommend a maximum ERO of 12% to construct a portfolio as shown in Figure 3.

That does not require a mean of 12% but the upside potential + ERO should be 12% or greater (e.g., Figure 3 has a ERO of 10% + an upside potential of 6.5% for a total potential of 16.5%).

We believe our methodology for estimating the total distribution of returns is more rigorous than simply calculating the average historical return as an estimate of future returns.

Key Conclusions

This article calls into question some of the basic beliefs of modern portfolio theory:

- An asset that guarantees a return below an investor’s ERO would not be a risk free asset because it would guarantee failure to accomplish the investor’s goal. It may be free of default risk but it is not free of investment risk.

- Asset management models like CAPM are ill-suited for investment problems dealing with future payouts like retirement programs, endowment plans, insurance companies and college expenses for children.

- The notion that active managers cannot do better than passive indexes is called into question. The best solution is shown to be an optimal combination of both.

- To have a conversation about what ERO can do for you contact us today.

Footnotes:

- We used the ERO calculator available here.

- PMPT is explained in “Managing Downside Risk in Financial Markets” and “The Sortino Framework for Constructing Portfolios” Amazon.com

See “Why it’s Time to Retire the 401(k), Pensions & Investments magazine, October 10, 2009 - Figure 3 is an output file from the ERO® Optimizer. The single account managers shown may not be the managers we are currently recommending and are not the only managers that could have been selected to add value.

- We fit a three parameter lognormal curve through 10,000 annual returns using Bradley Efron’s bootstrap procedure.

- The Pension Protection Act specifies managed accounts as a Qualified Default Investment Alternative (QDIA).

- The functional form of the utility function should reflect the investor’s preferences to determine which expected portfolio distribution is preferred. Much has been written about the S shaped function, the HARA class, and of course, the quadratic. In Figure 3 we take the expected value of a form of the Fishburn utility function to maximize the portfolio ERO® α of active managers and passive indexes.