When I entered this field some 40 years ago, I had the great fortune to work inside a few very successful boutique firms.

I was a purest. I was going to outwork everyone and become the best stock picker/analyst on Wall Street. One firm, in particular, began growing rapidly. Everyone was excited and energized.

However, the Chief Investment Officer and owner was perhaps the worst stock picker ever.

All he wanted to do was find out what other people were buying and he inevitably wound up buying what the best managers were selling.

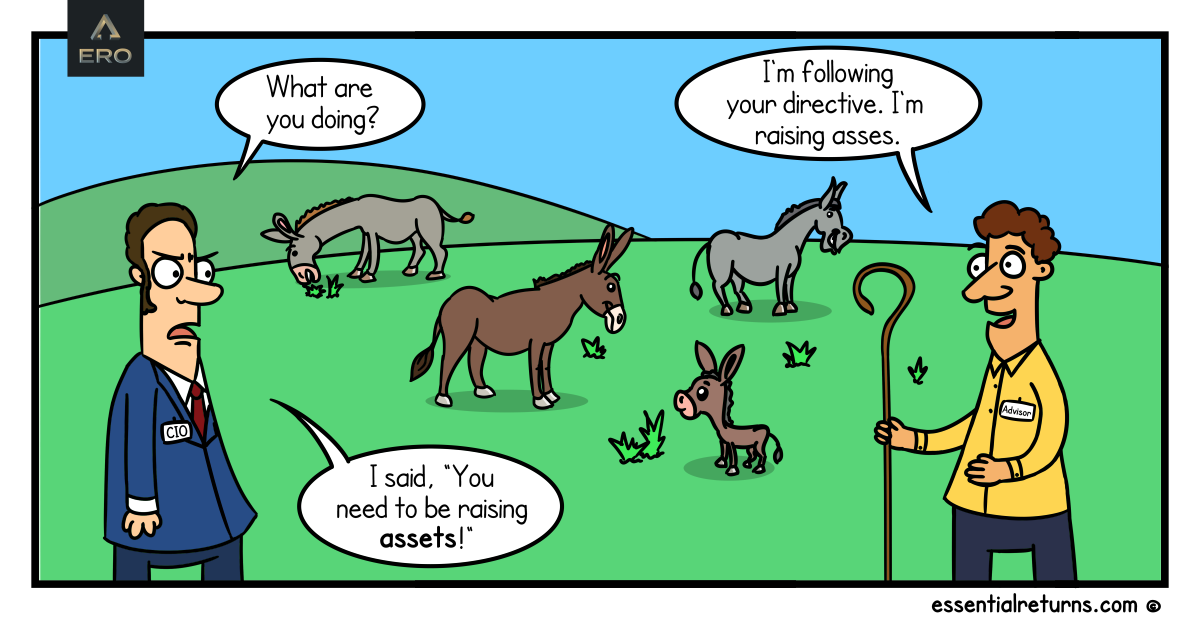

Performance was not something we discussed much. But the business grew rapidly raising assets.

Recently I walked around the offices of a well-known, successful regional brokerage firm.

All the brokers staring diligently, thoughtfully into the magic computer screen.

They sipped coffee, looking pensive and wise. And it occurred to me, this was not how firms grow.

The most successful firms clear the way for everyone to raise assets.

Without a singularly focused effort to raise assets, your business stagnates.

In our industry today, we have one of the largest firms so focused on asset gathering they will never discuss performance, instead declare lower fees means better money management. Really?

I’m still a purest. However, staring into the magic computer screen does not grow your business.

Granted, there is a unique rush that results from finding a stock or mutual fund for your clients that soars. I think we all have had that euphoric warmth of floating down the street convinced we are a stock-picking genius.

Isn’t it funny how soon afterward we have a few investments miss the number or get swept up in someone else’s bad news and our other ideas get slammed?

ERO has developed a unique analytical tool increasing the probability of achieving a required investment return towards investment success.

In addition, ERO frees up your time to do what makes the business grow and flourish – raising assets.

Let us show you how.

It’s time to think differently about growth.